Business Insurance in and around Mandeville

One of Mandeville’s top choices for small business insurance.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or problem. And you also want to care for any staff and customers who stumble and fall on your property.

One of Mandeville’s top choices for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

With options like errors and omissions liability, business continuity plans, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Justin Clemmons is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

So, take the responsible next step for your business and visit with State Farm agent Justin Clemmons to investigate your small business insurance options!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

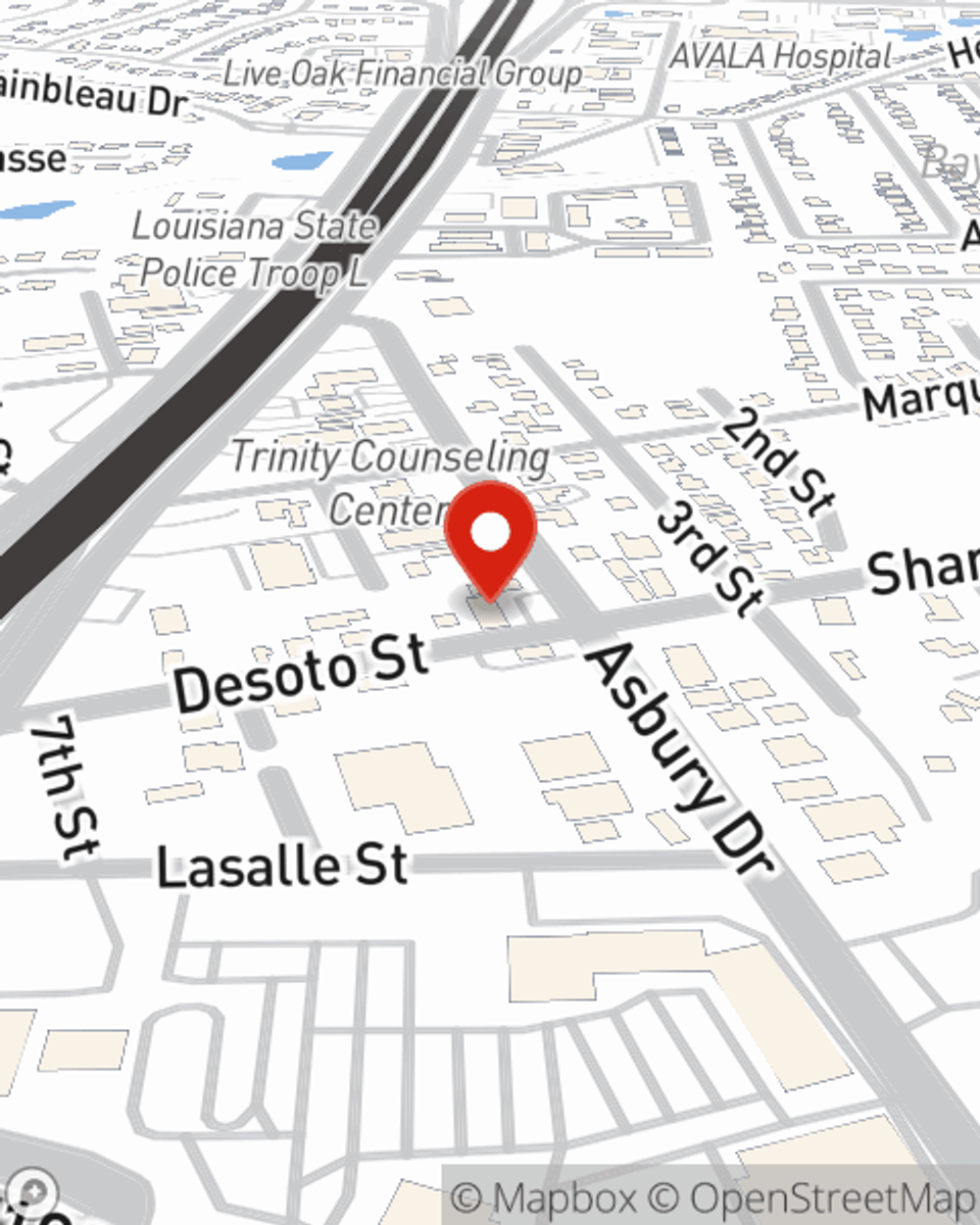

Justin Clemmons

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.